Get the free form 8946

Show details

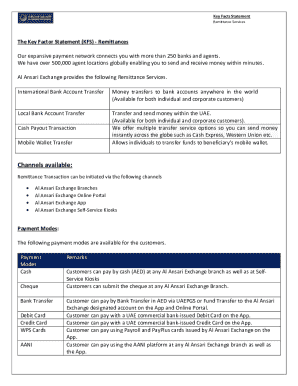

Form PTIN Supplemental Application For Foreign Persons Without a Social Security Number Rev. September 2012 Department of the Treasury Internal Revenue Service Information OMB No. 1545-2189 about Form 8946 and its instructions is at www.irs.gov/form8946. Cat. No. 37764H Form 8946 Rev. 9-2012 THIS PAGE INTENTIONALLY LEFT BLANK Page 3 General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Future Developmen...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 8946 form

Edit your form 8946 ptin supplemental application for foreign persons without a social security number form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 8946 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8946 irs online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 8946. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8946

How to fill out form 8946:

01

Gather all necessary information and documentation required to complete the form. This includes your personal information, employer information, and any relevant financial information.

02

Begin by providing your name, Social Security number, and contact information in the designated fields on the form.

03

Next, provide your employer's name, address, and employer identification number (EIN) in the corresponding sections.

04

Complete the remaining sections of the form by providing the required information regarding your employer's compliance with the employer shared responsibility provisions of the Affordable Care Act. This may include details about affordable coverage offered, employee contributions, and the number of full-time employees.

05

Double-check all the information you have entered to ensure accuracy and completeness.

06

Sign and date the form to certify that the information provided is true and correct.

07

Keep a copy of the completed form for your records and submit the form as directed by the IRS or your employer.

Who needs form 8946:

01

Employers who are subject to the employer shared responsibility provisions of the Affordable Care Act may be required to use form 8946.

02

This includes employers who have 50 or more full-time employees (including full-time equivalent employees) and are therefore considered an applicable large employer (ALE).

03

Form 8946 is used to provide the IRS with necessary information about the employer's compliance with the Affordable Care Act, specifically related to the employer's reporting requirements and potential liability for the employer shared responsibility payment.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 8946?

Form 8946 is used by foreign persons without a social security number (SSN) who want to prepare tax returns for compensation. Foreign persons who are tax return preparers must obtain a preparer tax identification number (PTIN) to prepare tax returns for compensation.

What do I attach to form 8453?

Acceptable attachments to Form 8453 include Form 1098-C Contributions of Motor Vehicles, Boats and Airplanes. Form 2848 Power of Attorney and Declaration of Representative. Form 3115 Application for Change in Accounting Method. Form 3468 Investment Credit. Form 4136 Credit for Federal Tax Paid on Fuels.

Where do I file 8453?

Where to File Forms Beginning with the Number 8 Form Name (For a copy of a Form, Instruction, or Publication)Address to Mail Form to IRS:Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file ReturnInternal Revenue Service Attn: Shipping and Receiving, 0254 Receipt and Control Branch Austin, TX 73344-025447 more rows

What is a w12 form?

Use this form to apply for or renew a paid preparer tax identification number (PTIN).

Can a non US citizen apply for PTIN?

A foreign preparer who does not have and is not eligible to obtain a social security number and is neither a citizen of the U.S. nor a resident alien of the U.S. as defined in section 7701(b)(1)(A) will need to complete the Form W-12PDF, IRS Paid Preparer Tax Identification Number (PTIN) Application and Form 8946PDF,

Can form 8453 be filed electronically?

Submit the signed form FTB 8453-FID to the fiduciary's ERO. After the fiduciary's return is e-filed, the fiduciary must retain the following documents for the California statute of limitations period: • Form FTB 8453-FID (signed original or copy of the form).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8946 to be eSigned by others?

Once your form 8946 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for the form 8946 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your form 8946 in minutes.

Can I edit form 8946 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share form 8946 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is 8946 form?

The 8946 form, also known as the 'Preparer's Signature' form, is used by tax professionals to report information related to tax return preparation services.

Who is required to file 8946 form?

Tax preparers who are paid to provide tax preparation services must file the 8946 form.

How to fill out 8946 form?

To fill out the 8946 form, tax preparers must provide their identifying information, sign the form, and include any supporting documents that are required.

What is the purpose of 8946 form?

The purpose of the 8946 form is to ensure that tax preparers are properly identified and compliant with IRS regulations.

What information must be reported on 8946 form?

The 8946 form requires reporting of the tax preparer's name, address, Social Security number or Employer Identification Number, and signature, along with other relevant details.

Fill out your form 8946 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8946 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.